When a doctor writes a prescription for a brand-name drug, you might expect your pharmacist to hand you a cheaper generic version-unless the law lets them. In most U.S. states, pharmacists are allowed to swap brand drugs for FDA-approved generics automatically, unless the doctor says no. That’s the system designed to save consumers billions. But over the past 20 years, big pharmaceutical companies have found ways to break it. They don’t just wait for patents to expire. They actively sabotage the system to keep prices high. This isn’t just shady business-it’s illegal under U.S. antitrust law.

How Product Hopping Kills Generic Competition

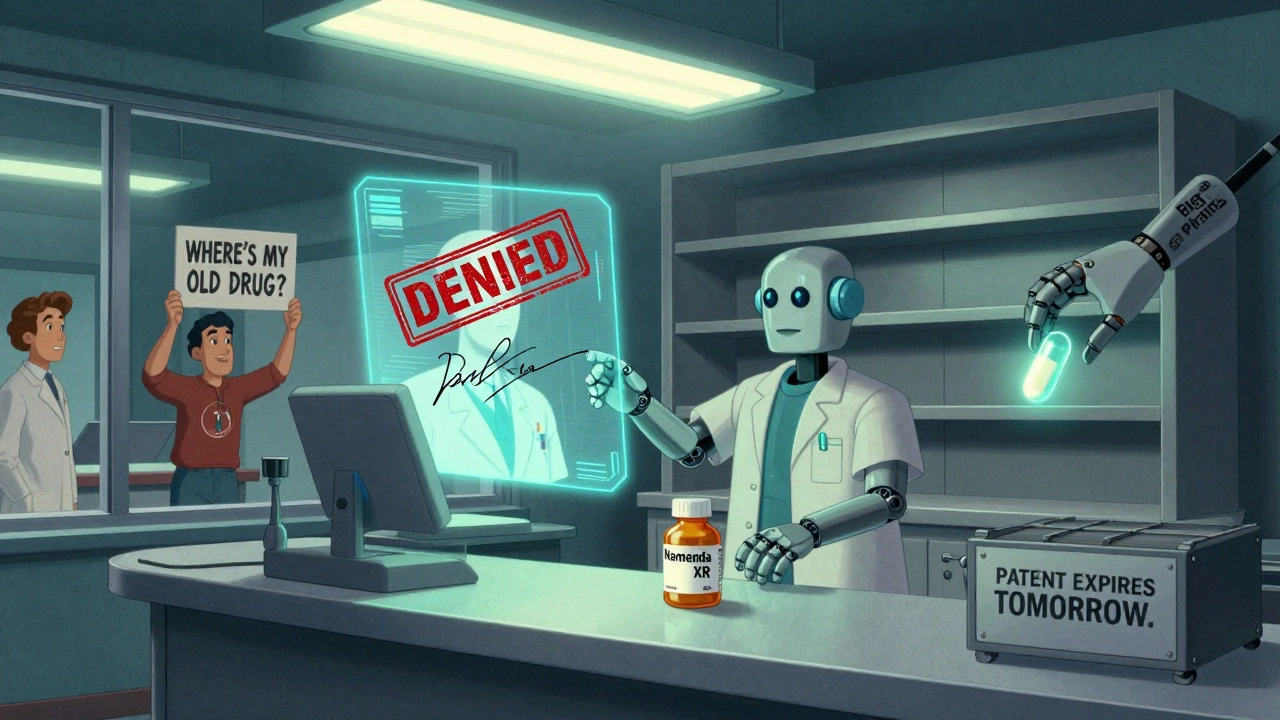

The most common tactic is called product hopping. It works like this: a brand-name drug is about to lose patent protection. Generic versions are ready to hit the market. Instead of letting the original drug compete on price, the company pulls it off shelves and replaces it with a slightly modified version-maybe a new pill shape, a slow-release formula, or a different coating. They market it as an "improvement," even if it offers no real medical benefit. Then they do something critical: they stop selling the original drug. Suddenly, pharmacists can’t substitute the generic for the version that’s still on the market. The only version left is the new one, which is still under patent. So even though generics are legally allowed to replace the old drug, they can’t because the old drug no longer exists. This happened with Namenda, a drug for Alzheimer’s. In 2013, manufacturer Actavis withdrew the original immediate-release version and replaced it with Namenda XR, an extended-release tablet. Thirty days before generics were set to enter the market, they pulled the original. Patients who were stable on the old version had to switch to the new one-often requiring a new prescription. Because switching back to the original was nearly impossible, generics couldn’t compete. The Second Circuit Court of Appeals ruled in 2016 that this was anticompetitive. The court said: "This wasn’t innovation. It was a legal loophole exploited to block competition."Why State Substitution Laws Are the Target

State laws that allow automatic generic substitution were created to cut costs. When a drug goes generic, pharmacies can fill prescriptions with the cheaper version without calling the doctor. That’s how most patients get savings-without any extra effort. But pharmaceutical companies know this system works. So they target it. The FTC found that when automatic substitution is allowed, generics capture 80 to 90% of the market within months. But when product hopping is used, that number drops to 10 to 20%. That’s billions in lost savings. The FTC’s 2022 report showed that in one case, a company introduced a chewable version of the birth control pill Ovcon and stopped selling the original. The result? Generic Ovcon couldn’t enter the market at all. The legal problem isn’t just about changing the drug. It’s about removing the version that generics are designed to replace. Courts have drawn a line: if the original drug stays on the market, even with a new version added, it’s usually seen as competition. But if the original is pulled before generics can enter, that’s a red flag. The 2009 Nexium case failed because AstraZeneca kept selling Prilosec. The 2016 Namenda case succeeded because Actavis removed Namenda IR.REMS Abuse: Blocking Generic Access to Samples

Another tactic is hiding behind FDA safety programs called REMS (Risk Evaluation and Mitigation Strategies). These were meant to control dangerous drugs-like those with high addiction risk or birth defect potential. But companies now use them to block generic manufacturers from getting the samples they need to prove their drug is bioequivalent. To get FDA approval, a generic maker must test its version against the brand-name drug. But if the brand company refuses to sell samples-or charges exorbitant prices, or imposes impossible restrictions-the generic can’t launch. According to legal scholar Michael A. Carrier, more than 100 generic companies have reported being blocked this way. A 2017 study found that in 40 drugs with restricted access programs, the delay cost the system over $5 billion a year. The FTC called this "a textbook case of monopolization." Why? Because the brand company gains nothing from denying samples except to hurt competitors. There’s no safety reason. No business reason. Just one: keep prices high.

Legal Battles: Who’s Winning and Why

Not all product hopping cases end the same way. Courts are split. In the Suboxone case, Reckitt Benckiser withdrew the original tablet version and pushed a film strip form. They claimed the tablet was unsafe-despite no evidence. The FTC found this was a scare tactic to force doctors and patients to switch. In 2019 and 2020, the FTC won settlements totaling hundreds of millions. But in the Nexium case, AstraZeneca introduced a new version while keeping Prilosec on the market. The court dismissed the case, saying adding a new product is good for consumers. The difference? Availability. If the old drug is still there, courts see it as competition. If it’s gone, they see it as sabotage. The FTC’s 2022 report highlighted this inconsistency. Some judges still believe generics can "just spend more on advertising" to win back customers. But that ignores reality: patients don’t choose generics based on ads. They choose based on what’s in the bottle at the pharmacy counter. If the original drug is gone, the pharmacy can’t fill the prescription with a generic. No amount of marketing changes that.Enforcement: What the FTC and DOJ Are Doing

The FTC has shifted from warnings to lawsuits. After years of inaction, they began challenging product hopping head-on. In the Namenda case, they got a court order forcing Actavis to keep selling the old version for 30 days after generics entered. That small window allowed generics to gain traction. The Department of Justice has also stepped in-not just against brand companies, but against generic makers too. In 2023, Teva paid a $225 million criminal fine for price-fixing with other generic manufacturers. Glenmark paid $30 million. These cases show regulators are now watching both sides: big brands blocking competition, and generic companies colluding to raise prices. State attorneys general are joining the fight. New York’s AG won an injunction against Actavis in 2014. Since then, at least 15 other states have launched investigations. Congress has also taken notice. In 2023, the House Committee on Appropriations directed the FTC to report on its efforts to stop these tactics.

The Cost to Patients and the System

The numbers are staggering. The FTC estimates that delayed generic entry costs U.S. patients and taxpayers billions every year. Just three drugs-Humira, Keytruda, and Revlimid-have cost the system an estimated $167 billion since 2010 because generics were blocked from entering the market. Revlimid’s price jumped from $6,000 to $24,000 per month over 20 years. In Europe, where product hopping is blocked by law, generics arrived faster and prices stayed lower. One study found that when generics are allowed to enter without interference, patients save an average of 80% on their prescriptions. But when companies use product hopping, those savings vanish. Patients end up paying hundreds or thousands more each year. Insurance companies and Medicare pay more. Taxpayers foot the bill.What’s Next? The Fight Isn’t Over

Regulators are pushing for stronger rules. The FTC wants Congress to pass laws that make it illegal to withdraw a drug solely to block generic competition. They also want to limit REMS abuse by requiring brand companies to provide samples at fair prices within a set timeframe. Legal experts agree: the current patchwork of court rulings is unstable. Some judges see product hopping as innovation. Others see it as fraud. That inconsistency lets companies keep trying new tricks. The solution? Clear federal law that says: if you pull a drug off the market to prevent generic substitution, you’re breaking the law. For now, the best defense is awareness. Patients should ask: "Is this the same drug I’ve been taking?" Pharmacists should track when brand companies pull older versions. Advocates should push state legislatures to strengthen substitution laws. And regulators must keep suing. This isn’t about stopping innovation. It’s about stopping deception. Companies can develop better drugs. But they can’t be allowed to game the system to keep prices high while pretending they’re helping patients.What is product hopping in pharmaceuticals?

Product hopping is when a brand-name drug company withdraws an older version of a drug just before its patent expires and replaces it with a slightly modified version-like a new pill form or extended-release formula-that’s still under patent. This blocks pharmacists from substituting cheaper generics, since the original drug is no longer available.

Is it legal for drug companies to pull a drug off the market?

It’s legal to discontinue a drug for legitimate business or safety reasons. But if the only reason is to block generic competition-especially when the original drug is pulled right before generics can enter-it’s considered an antitrust violation. Courts have ruled this way in cases like New York v. Actavis.

How do REMS programs help big pharma block generics?

REMS programs are meant to manage drug risks, but some brand companies use them to deny generic manufacturers access to the samples needed to prove their drug is bioequivalent. Without those samples, generics can’t get FDA approval. The FTC has called this a deliberate tactic to delay competition and maintain monopoly pricing.

Why don’t generics just advertise to win back customers?

Patients don’t choose drugs based on ads. They get what’s dispensed at the pharmacy. If the original drug is gone and the only available version is the new, patented one, the pharmacist can’t legally substitute a generic-even if the patient wants it. Advertising can’t fix that system-level block.

What’s being done to stop these practices?

The FTC and DOJ have filed lawsuits against companies like Actavis and Reckitt Benckiser. They’ve won injunctions and settlements totaling hundreds of millions. Congress is also considering new laws to ban product hopping and reform REMS abuse. State attorneys general are investigating, and public pressure is growing.

Rachel Nimmons

December 4, 2025 AT 19:39they’ve been doing this since the 90s… i swear the whole system is rigged. you think you’re getting healthcare but you’re just feeding a machine that prints money while you pay 3x more for the same pill. they don’t even care if you die slow. just as long as the stock goes up.

Abhi Yadav

December 5, 2025 AT 12:51capitalism is just modern feudalism with better packaging 🤷♂️

pharma lords rule the land

we are the serfs with prescriptions

the pill is our bread

and the patent is our chain

Julia Jakob

December 6, 2025 AT 09:56so let me get this straight… they make a tiny change to a pill, call it ‘new and improved,’ then yank the old one so you can’t get the cheap version? 😑

and we’re supposed to be impressed? this isn’t innovation, this is just scamming with a lab coat.

my grandpa used to say ‘if it looks too easy to be legal, it probably ain’t.’ guess he was right.

and don’t even get me started on how they use ‘safety’ as an excuse to block generics. lol. sure. right.

Kathleen Koopman

December 6, 2025 AT 19:58omg this is so real 😭

i had to switch from generic omeprazole to esomeprazole because the old one vanished and now my insurance won’t cover it unless i pay $120/month. i’m on disability. this isn’t healthcare. this is extortion. 🤬

Nancy M

December 7, 2025 AT 19:56It is worth noting that the structural incentives within the pharmaceutical industry are misaligned with public health outcomes. When profit margins are tied to patent exclusivity rather than therapeutic efficacy, the market distorts toward rent-seeking behavior. This is not merely unethical-it is a systemic failure of regulatory architecture. The FDA, FTC, and DOJ must be granted greater statutory authority to preemptively block anti-competitive product redesigns. Without legislative intervention, the public will continue to subsidize corporate malfeasance.

gladys morante

December 7, 2025 AT 23:47they don’t care if you live or die. they just want your money. i’ve seen people skip doses because they can’t afford the new version. it’s not medicine anymore. it’s a weapon.

Bethany Hosier

December 8, 2025 AT 08:38Let me be perfectly clear: this is not an isolated incident. It is a coordinated, multi-decade campaign orchestrated by corporate interests with deep ties to regulatory agencies. The FDA’s REMS protocols were never meant to be used as a gatekeeping mechanism. The fact that they are being weaponized in this manner is not accidental-it is intentional. And those who defend it as ‘safety’ are either complicit or willfully ignorant. The truth is: if you’re not outraged, you’re part of the problem.

Krys Freeman

December 9, 2025 AT 23:44so what? they’re companies. they make money. if you can’t afford your meds, get a better job. america is the land of opportunity. stop whining.

Shawna B

December 10, 2025 AT 10:56so they just stop selling the old pill so you can’t get the cheap one? that’s it? that’s the whole plan?

Jerry Ray

December 11, 2025 AT 16:01wait-so the real villain here isn’t the pharma companies… it’s the pharmacists? because they’re the ones who could’ve just handed you the generic if they wanted to? maybe the problem is that people don’t know how to ask for it? maybe we’re just too lazy to read the label?

David Ross

December 12, 2025 AT 01:58This is not merely a violation of antitrust statutes-it is a profound betrayal of the social contract. The pharmaceutical industry, as a quasi-public trust, has been granted extraordinary regulatory privileges in exchange for ensuring equitable access to life-saving therapeutics. When those privileges are exploited to manufacture artificial scarcity, the moral and legal obligations of corporate personhood are nullified. The FTC’s enforcement actions, while commendable, are reactive and insufficient. What is required is ex ante legislation that criminalizes product withdrawal as a predatory tactic, with mandatory restitution to affected consumers. The time for half-measures is over.