When your pharmacist hands you a different pill than what your doctor prescribed, it’s not a mistake - it’s Medicare Part D substitution. But not all substitutions are allowed, and not all plans treat them the same. Understanding how this works can save you hundreds - or even thousands - in out-of-pocket costs each year.

What Exactly Is Medicare Part D Substitution?

Medicare Part D substitution happens when a pharmacy replaces one drug with another that’s considered medically similar. This usually means swapping a brand-name drug for a generic version, or switching between two drugs in the same therapeutic class. But here’s the catch: your plan’s formulary - the official list of covered drugs - decides what’s allowed.Not every drug can be swapped. For example, if your doctor writes a prescription for a specific brand of insulin, the pharmacy can’t just give you a different brand unless your plan allows it and your doctor hasn’t blocked substitution. Some drugs are labeled "Do Not Substitute" by the prescriber. That means the pharmacist must fill it exactly as written.

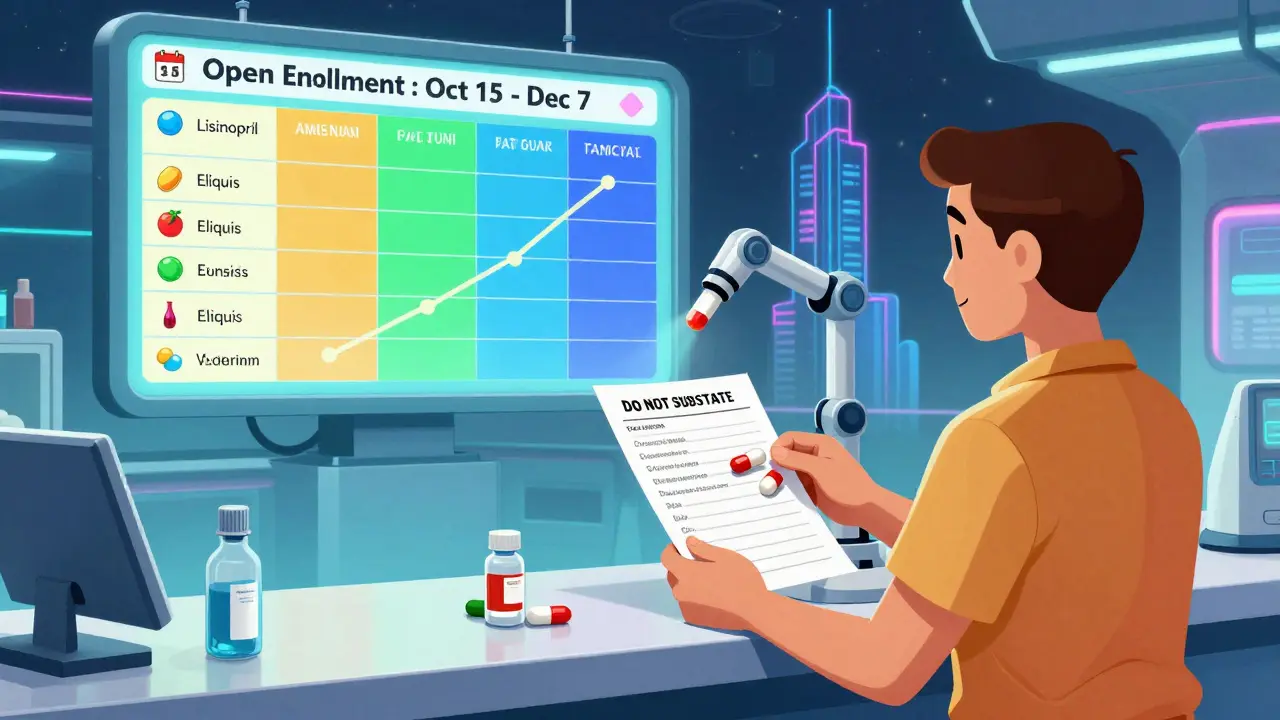

Most substitutions are driven by cost. Part D plans use a five-tier system to encourage cheaper options:

- Tier 1: Preferred generics - lowest cost, often $0-$5 copay

- Tier 2: Non-preferred generics - slightly higher, maybe $10-$15

- Tier 3: Preferred brand-name drugs - $40-$60 copay

- Tier 4: Non-preferred brands - $70-$100+ copay

- Tier 5: Specialty drugs - hundreds per month, often coinsurance

Plans push you toward Tier 1 and 2 drugs because they’re cheaper for everyone - you, the plan, and the government. If your doctor prescribes a Tier 4 drug, your pharmacist may suggest a Tier 2 generic instead. But they can’t force it. You have the right to say no.

How Formularies Control What Gets Swapped

Your Part D plan’s formulary is the rulebook for substitution. Each plan creates its own, but all must meet federal minimum standards. The problem? There are over 48 Part D plans available in 2025, and each has a different list. One plan might cover Humira with low cost-sharing; another might not cover it at all and only list Enbrel or a biosimilar.Pharmacy Benefit Managers (PBMs) - the middlemen hired by insurance companies - decide which drugs go on which tier. They negotiate discounts with drugmakers. The drugs they get the best deals on? Those get placed on lower tiers. That’s why a drug you used to get for $10 might suddenly cost $80 - it got moved from Tier 1 to Tier 4.

Here’s what you need to know: formularies change every year. A drug covered in December might be removed by January. If you’re on a medication that gets dropped, you’ll get a notice from your plan. You can appeal the change, ask your doctor for a prior authorization, or switch plans during Open Enrollment (October 15 to December 7).

The $2,000 Out-of-Pocket Cap Changed Everything

Before 2025, Medicare Part D had a "donut hole" - a coverage gap where you paid 100% of drug costs after hitting a certain spending threshold. That made substitution a survival tactic. If your drug cost $500 a month and you hit the gap, you’d skip doses or beg for samples.The Inflation Reduction Act wiped out the donut hole as of January 1, 2025. Now, once you’ve spent $2,000 out-of-pocket on covered drugs, you enter catastrophic coverage. After that, you pay nothing for the rest of the year.

This changes substitution dynamics. Before, people rushed to switch to cheaper drugs to avoid the gap. Now, if you’re close to $2,000, it might make more sense to stick with your current drug - even if it’s expensive - because you’re about to hit free coverage. There’s no penalty for using a higher-cost drug once you’re in catastrophic coverage.

For 2026, the cap rises to $2,100. But the rule stays the same: after you hit it, your drugs are free. That means substitution pressure drops significantly for people on high-cost medications like cancer drugs or biologics.

Therapeutic Interchange: When Doctors and Pharmacists Swap Drugs

Sometimes, substitution isn’t just about generics. It’s about switching from one brand to another in the same drug class - like swapping one statin for another. This is called therapeutic interchange. It’s common in Medicare Advantage plans that bundle medical and drug coverage.But here’s the twist: your plan may require step therapy first. That means you have to try a cheaper drug before they’ll approve the one your doctor picked. For example, if your doctor prescribes a new type of blood pressure med, your plan might require you to try lisinopril (a generic) first. If that doesn’t work, you can appeal.

Step therapy doesn’t always make sense. If you’ve been on a specific drug for years and it works, you shouldn’t have to restart from scratch. You can file an exception request with your plan. Include a letter from your doctor explaining why the alternative won’t work for you. Many approvals happen within 72 hours.

What Happens When Your Drug Gets Removed From the Formulary?

This is the nightmare scenario: you’ve been on a drug for years, and one day your plan says, "We’re no longer covering it." You show up at the pharmacy, and they hand you a different pill - one you’ve never taken.There are three ways to handle this:

- Appeal the decision. Submit a formal request to your plan. Include your doctor’s note. Most appeals are approved if medical necessity is clear.

- Ask for a transition fill. If you’re mid-treatment (like for diabetes or heart disease), the plan must give you a 30-day supply of your old drug while you appeal or switch plans.

- Switch plans during Open Enrollment. If your drug keeps getting kicked off formularies, it’s time to find a new plan. Use Medicare’s Plan Finder tool to compare coverage for your exact medications.

Don’t wait until you run out. If you know your drug is being removed, act before January 1. The window to switch plans closes on December 7.

Special Cases: Insulin, Vaccines, and Other Exceptions

Some drugs have special rules. Insulin, for example, is capped at $35 per month for a 30-day supply across all Part D plans in 2025. That means substitution for insulin is less about cost and more about convenience - you can swap one type of insulin for another if your doctor approves, but your out-of-pocket cost stays the same.Vaccines are covered at $0 cost-sharing. That includes flu shots, shingles, pneumonia, and COVID boosters. You can’t substitute a vaccine for another unless it’s medically appropriate - and even then, your plan must cover the one your doctor prescribes.

Some plans offer extra help for high-cost drugs. Humana, for instance, has programs to help people on expensive biologics. Others offer mail-order discounts or 90-day supplies to reduce costs. Check your plan’s website for these perks.

How to Protect Yourself From Unexpected Substitutions

You can’t control every substitution, but you can control your preparation:- Always check your plan’s formulary before enrolling - not just during Open Enrollment, but every year.

- Use the Medicare Plan Finder tool to enter your exact drugs and see which plans cover them at the lowest cost.

- Ask your pharmacist: "Is this a substitution?" If they say yes, ask why and what the difference is.

- Keep a printed list of your medications, dosages, and why your doctor prescribed them. Bring it to every appointment and pharmacy visit.

- If you’re on a high-cost drug, ask your doctor if there’s a generic or biosimilar that’s covered on your plan’s lowest tier.

Don’t assume your plan will tell you about changes. Most formulary updates happen quietly in November. If you don’t review your plan’s materials, you’ll be caught off guard.

What to Do If You’re Denied a Substitution

Sometimes, your plan says no to a substitution - even when it makes sense. Maybe they won’t cover a generic you want, or they won’t approve a step therapy exception.You have rights:

- Request an exception in writing. Include your doctor’s note and medical records.

- Ask for an expedited review if your health is at risk.

- If denied, you can appeal to an independent third party. Most plans have a 60-day window.

- Call Medicare at 1-800-MEDICARE for help navigating the process.

Don’t give up. Many denials are overturned on appeal - especially if your doctor explains why the alternative won’t work.

Can my pharmacist switch my drug without telling me?

No. Pharmacists must inform you if they’re substituting a drug. If you’re handed a different pill than what your doctor wrote, ask why. You have the right to refuse and request the original prescription. Some states require pharmacists to document substitutions in writing.

Why does my Part D plan cover one generic but not another?

It’s all about contracts. Your plan’s Pharmacy Benefit Manager (PBM) negotiates deals with specific drug manufacturers. One generic might be cheaper because the PBM got a bulk discount. Another might be excluded because the manufacturer didn’t offer a good deal. It’s not about quality - it’s about pricing.

Does Medicare Part D cover over-the-counter drugs?

No. Medicare Part D only covers prescription drugs. Over-the-counter items like pain relievers, antacids, or allergy meds are not included - even if your doctor recommends them. Some Medicare Advantage plans offer limited OTC allowances, but that’s separate from Part D coverage.

What if I travel and need a refill out of state?

Most Part D plans have national networks, so you can fill prescriptions anywhere in the U.S. But if you’re using a specialty pharmacy or a plan with limited network pharmacies, you might pay more. Always call ahead to confirm the pharmacy is in-network. For long-term travel, consider switching to mail-order for steady supply.

Can I switch Part D plans anytime if substitution issues arise?

Only during the Annual Enrollment Period (October 15 to December 7) or if you qualify for a Special Enrollment Period - like moving out of your plan’s service area, losing other coverage, or entering a long-term care facility. You can’t switch just because your drug was moved to a higher tier. Plan ahead.

Next Steps: What to Do Right Now

If you’re on Medicare Part D, here’s what to do in the next 30 days:- Log in to Medicare.gov and use the Plan Finder tool. Enter your exact medications and zip code.

- Compare your current plan’s formulary with at least two others. Look for the lowest total cost - not just the monthly premium.

- Call your pharmacy and ask: "What drugs am I currently on, and what tier are they on?"

- Write down your top three medications and check if they’re covered without restrictions on your plan.

- If anything looks risky, mark October 15 on your calendar. That’s when you can switch plans for next year.

Don’t wait until you’re out of pills. A small change now - like switching to a plan that covers your drug on Tier 1 - could save you $1,200 a year. And with the $2,000 out-of-pocket cap in place, you’re closer to free drugs than you think.

Alexandra Enns

January 25, 2026 AT 10:15So let me get this straight - the government now pays for your drugs after you spend $2,000? That’s not healthcare, that’s a free ride for people who can’t budget. My cousin in Alberta pays $800 a year for insulin and doesn’t even have Medicare. This system is broken and it’s punishing the responsible.

And don’t even get me started on PBMs - those middlemen are raking in billions while seniors get stuck with the bill. It’s corporate welfare with a red white and blue bow.

Also - why are we letting pharmacists swap drugs at all? If my doctor wrote ‘Humira,’ then Humira is what I get. No ‘therapeutic interchange’ nonsense. This is medicine, not a grocery store sale.

Marie-Pier D.

January 26, 2026 AT 20:11Thank you for this 🙏 I’ve been terrified of switching plans this year because I’m on a biologic and I didn’t know about the $2,000 cap. I literally cried when I read that part - I’ve been skipping doses just to stretch my supply. This changed everything.

Also, I called my pharmacy yesterday and asked if my drug was a substitution - they said yes, and gave me a printed sheet explaining the difference. That’s the kind of care we need more of.

Everyone, please check your formulary. Don’t wait until January. I almost lost my meds because I assumed nothing changed. Don’t be like me 😭

Shanta Blank

January 27, 2026 AT 15:06Oh honey. You think this is bad? Wait till you see what happens when the PBM’s CEO’s cousin owns the generic factory. This isn’t about cost savings - it’s about who got the bribe.

My aunt got switched from her $10 generic to a $75 ‘equivalent’ because the PBM got a kickback from the new manufacturer. She had a stroke because she couldn’t afford to refill. The ‘therapeutic interchange’? More like therapeutic sabotage.

And now they’re telling us the $2,000 cap is a win? Please. That’s just the government saying ‘we’re tired of your dying in the donut hole, so here’s a lollipop.’ It doesn’t fix the fact that drug companies jack prices up 500% every year.

Also - why is no one talking about how Medicare Advantage plans are secretly steering people away from expensive drugs? They’re not ‘substituting’ - they’re gaslighting you into thinking your meds are ‘unnecessary.’

Tiffany Wagner

January 27, 2026 AT 21:07just read this and it made so much sense

i never knew you could ask for a transition fill

my mom got switched to a different insulin last year and we thought we were stuck

turns out we could’ve fought it

thank you for writing this

also the $35 insulin cap is a game changer

why did no one tell us this sooner

Vatsal Patel

January 29, 2026 AT 03:08Let me ask you something - if you’re smart enough to understand your formulary, why are you on Medicare at all? You’re not poor, you’re just lazy. The system rewards ignorance. The $2,000 cap? That’s not compassion - it’s the state admitting it failed to teach you how to plan.

And you think pharmacists are your friends? They’re just the middlemen between the PBM and the drug cartel. You’re not getting cheaper meds - you’re getting the ones the algorithm picked for you.

Step therapy? That’s not healthcare. That’s corporate eugenics. You’re not a patient - you’re a data point. And if your drug doesn’t maximize profit? You’re out.

Meanwhile, in India, we pay $2 for insulin. But we don’t have Medicare. We have common sense.

Also - why are you surprised? You knew this was a system designed by accountants. You just didn’t want to admit it.

Sharon Biggins

January 29, 2026 AT 06:55i just wanted to say thank you for explaining the transition fill thing

i was so scared when my drug got removed

but now i know i can get 30 more days while i appeal

my doctor helped me write the letter and we got approved in 2 days

you’re not alone

and if you’re reading this and feeling overwhelmed

take a breath

you’ve got this

and if you need help calling your plan

i’m here

John McGuirk

January 30, 2026 AT 21:41They’re lying. The $2,000 cap? It’s a trap. They want you to spend up to it so they can justify cutting your meds next year. They’ll say ‘look, he hit the cap, he doesn’t need expensive drugs anymore.’

And the pharmacists? They’re not telling you the truth. I saw a guy get switched from his cancer drug to a cheaper one - the label said ‘same active ingredient.’ But the fillers? Different. He had seizures.

This is all connected. The PBMs, the drug companies, the government - they’re all in bed together. You think your plan is helping you? It’s harvesting your data to sell to insurers.

And the ‘formulary changes’? They happen in November because they know you’re too tired to fight. They count on your silence.

Don’t trust any of it. They’re playing you.

Michael Camilleri

February 1, 2026 AT 08:59Let me break this down for the people who think this is a win

You think the $2,000 cap means you’re getting a break? No. It means the government is finally admitting it’s been stealing from you for years. You paid premiums for decades and now they’re giving you back a fraction of what you lost

And don’t get me started on the ‘therapeutic interchange’ nonsense

My uncle was on Lipitor for 15 years. They swapped him for a generic that had different binders. He got rashes. They told him it was ‘allergy.’ No. It was the damn filler.

And the pharmacists? They don’t care. They get paid by the volume of substitutions they make. They’re not your friend. They’re a cog.

And the formularies change every year? That’s not a bug - it’s a feature. It keeps you confused. It keeps you dependent. It keeps you from realizing you’ve been had.

This isn’t healthcare. It’s a pyramid scheme with pills.