Prescription Drug Coverage: What It Includes and How to Maximize Your Benefits

When you hear prescription drug coverage, the part of your health insurance that pays for medications prescribed by a doctor. Also known as pharmacy benefits, it’s what keeps you from paying hundreds out of pocket for daily meds like blood pressure pills, insulin, or antidepressants. But not all coverage is created equal. Some plans cover generics only. Others require prior authorization just to fill a common script. And a few won’t touch certain brand-name drugs at all—even if they’re the only thing that works for you.

This is where formulary, a list of drugs your insurance agrees to pay for. Also known as preferred drug list, it’s the hidden rulebook that decides what you can get and how much you pay comes into play. Your plan might cover generic medications, lower-cost versions of brand-name drugs with the same active ingredients. Also known as generic drugs, they’re often 80% cheaper and just as effective but refuse to pay for the brand. That’s why switching to a generic, like metformin instead of Glucophage, can slash your monthly bill. But if your condition needs the brand, you might need to appeal—or find a different plan during open enrollment.

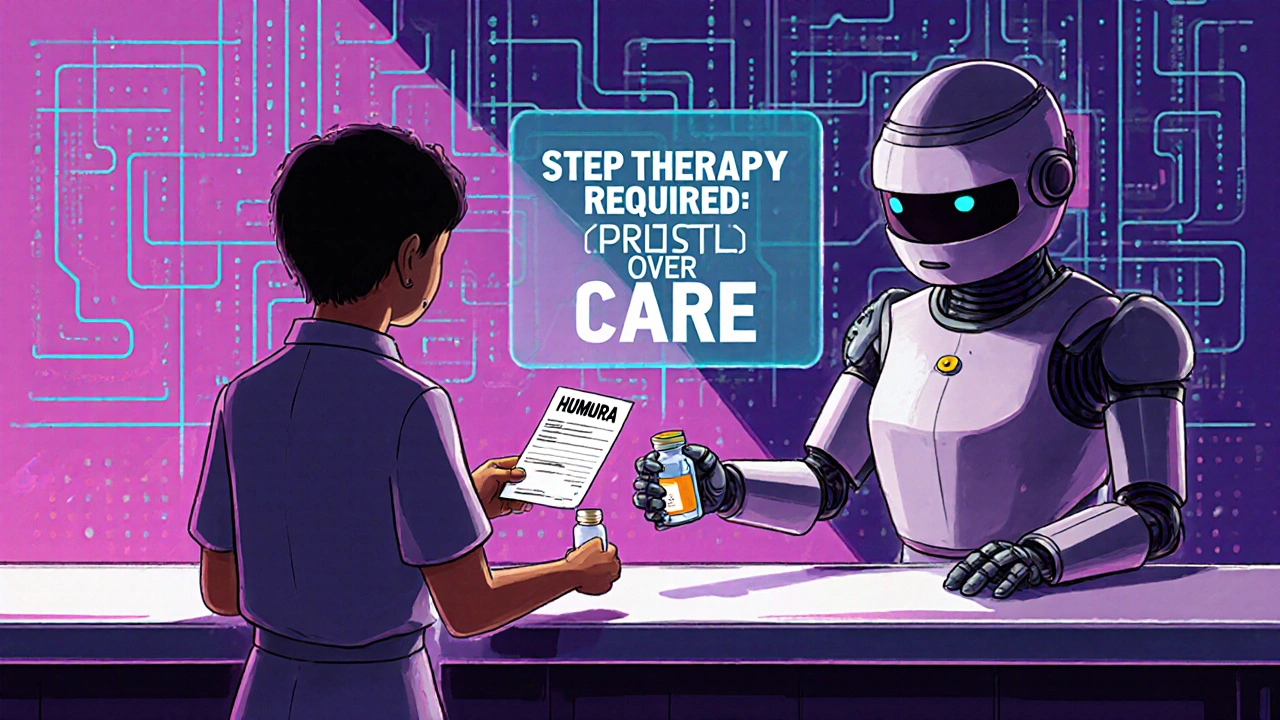

Prescription drug coverage doesn’t just mean ‘it’s covered.’ It means understanding tiers, copays, deductibles, and step therapy. Tier 1? Usually generics, $5 copay. Tier 4? Specialty drugs, $100+ per month. Some insurers make you try cheaper options first—like an older antihistamine—before approving Zyrtec or Claritin. That’s step therapy, and it’s everywhere. You’re not being difficult if you ask why. You’re just trying to get the right treatment without a financial hit.

And it’s not just about what’s on the list. It’s about how you use it. Did you know you can save hundreds a year by switching to combo generics? Or that some pharmacies offer cash prices lower than your insurance copay? Or that reporting rare side effects from generics helps fix safety gaps for everyone? These aren’t just tips—they’re power moves built into the system if you know where to look.

The posts below cover real-world examples of how people navigate these rules. You’ll find guides on how to read your drug label to avoid missed doses, how to find the cheapest version of your meds, how biosimilars can replace expensive biologics, and when to challenge your insurer’s decision. You’ll learn how to use the FDALabel database to check official drug info, how to spot when a generic might not work for you, and how to avoid allergy risks with common blood pressure drugs like azilsartan. This isn’t theory. It’s what people are doing right now to take control of their prescriptions—and their bills.

20 November 2025

20 November 2025

How to Appeal Insurance Denials for Generic Medications: A Step-by-Step Guide

Learn how to successfully appeal your insurance denial for generic medications with a step-by-step guide backed by real data, doctor tips, and proven strategies to get your prescribed drug covered.

11